How many of you have Whole Life insurance plans/Investment - linked policies (ILP) or Endowment plans?

I have a ILP before (started before I enlisted in 2008 and I stopped it back in 2016 thankfully) and currently have a Whole Life limited payment plan for 12 years. I'm 2 years into the plan and ever since I've known of index funds etc, I have been thinking if I should cancel the plan or if I should continue since I've already paid 2 years worth of premium.

So my premiums for this particular plan is $552.80 per month and I have another 10 more years to pay.

Coverage is for $300,000 until age 75 and $100,000 until age 99 for this policy.

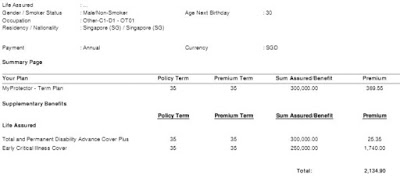

I did a calculation of how much I would incur should I opt for term plans instead ... I looked at DIYInsurance and got a quote for a Aviva Plan... It covers Death, Total Permanent Disability up to $300,000 and Early Critical Illness which is up to $250,000..

Let's look at the premiums that I would have paid for the next 10 years if I convert to term now.

Term Premium based on monthly for the above is $182.20, however because there is a $50,000 gap in the Early Critical Illness coverage as compared to my current plan, I'm just going to pump it up to around $220.

Deducting $220 from my current $552.80 leaves me with $332.80 to invest every month.

Let's see what $332.80 for 10 years get us based on 5% returns in the market.

At the end of the 10 years, I will get $51,581.36.

If I continue to be covered until 65, I will need to depend on my interest/gains to cover the premiums.

Based on this what it would look like at age 65 will be the below.

From the 10th year onwards I will actually need to dao tiap (eat into my principal sum) and the value goes down to $45,286.20 at the end of year 35 (age 65).

You can see that at age 65, the guaranteed value for my current policy is $55,100 and if we take the lower projected gain at 3.25%, I can expect to take $77,987.

Based on this projection, then definitely I would say remaining on the current policy is a better choice. I can even continue to stay covered and have the value grow for a longer period of time if I wanted to.

For me personally, I do feel that over a long time frame, investment returns of 7% or more are very likely especially for a 35 year period which we are looking at.

Why do I say 7%? You can read more about this here. Oh and while you're reading that, notice that the WORST 25 year period actually contributed 7.94% still?

So anyway, let us look at the figures if we utilise a 7% rate instead.

Excess funds of $332.80 invested monthly for a 10 year period...

......will bring us to a value of $57,247.88.

We then continue to keep this invested for 25 years and use the gains to cover our monthly premiums of $220.

This brings us to a value of $137,465.76 at the end of 35 years.

Compared to the guaranteed + non-guaranteed portion of my current policy based on 4.75%, the amount of $113,546 is lesser by 20 over thousand. Thus, looking at this situation which I personally believe is the more likely scenario, it makes more sense to go through this route.

Not everyone however wants to be covered forever since insurance is usually meant to cover for loss of income - and with my intention to FIRE I foresee that I don't really need to replace any 'loss' of income thus likely I will just keep my medical insurance but cancel the term/life policies.

Let's make a list of the pros and cons of having 2 of the different policy.

Term Plans

Whole Life Plans

*Feel free to let me know if I should add in anything to above tables!

Other factors/issues that one will need to consider such as

- Market crash happening at the point you want to withdraw would make a big dent on your expected payout

- Will you stay invested throughout or will you panic and sell when there is a crash?

- Can you get past the hurdle of knowing that you have wasted X number of years of premium? (2 in my case which is about $13,000+)

- Is the plan you are switching to covering the exact same things as the new one? Did you have any 'new' illnesses that would apply as exclusions should you convert?

To summarise this, I would say everyone should buy term and invest the rest in an index fund IF you are choosing between starting either options. For conversions, you really need to calculate to see if it is worth it. However, I would say term is only for people who are very confident that they can 'steel' themselves through a market downturn and continue putting in the funds instead of changing tracks midway.

Heck, I don't even know myself if I can stay committed to doing so during a market downturn as I've not gone through one major downturn during my working/investing life - hopefully maintaining this blog keeps me reminded of what I have committed myself to do over the long run.

Like what financial advisors always say, everyone's needs are different so I guess we need to understand ourselves before determining which plan is the right one for us. If you have a trusted financial advisor, ask them too! Though sadly a lot of financial advisors seem to prioritise their needs (*cough*....commission....*cough*) first over their customer's need so do be wary even if you talk to them and don't be pressurised.

I'm not advocating for anyone to cancel your insurance policies so again, please make your own calculations before you make any changes as everyone's situation is different. If I was into my 6th or 7th year of my current policy then I'm sure changing now would be a dumb move.

You can even check with me or any others to see if your calculations is accurate. I got KPO's help to go through some of my earlier numbers before I got the quote as well since I wanted to make sure what I'm tabulating makes sense (Thanks KPO!)

Well, that leaves me now with the task of showing the above to my wife and convincing her that we should 'convert' my current plan which she is not supportive of at this point.

If she refuses... Oh well... I've talked about it a few times and always got brushed away.

If with the numbers she still doesn't 'bite', I might just give up trying to convince her just to maintain a harmonious environment at home and go back to my mantra - Happy wife, happy life.. 家和万事兴

Hahaha. You are welcome! I agree - Happy wife, happy life :)

ReplyDeleteHi Wife Say I Niao,

ReplyDeleteI just want to ask, will STI give the same returns as S&P 500? I am invested into similar plans like you with Poems Sharebuilder and am keen to know.

My term plan at 1 million with 250k for critical illness only cost around $120 a month for 25 years. Heng ah, much cheaper. One thing to note is that as you age, you might need to top up money into your ILP as your insurance portion gets more expensive. Term plan is fixed so no need to top up at all.

Anyway, I cancelled my ILP 2 years into it and have not regretted ever since. For my case, it's not the losses I sunk into the premiums but the future losses that I am more concerned of.

In the end, definitely a happy wife is most important.

Hi Jes,

DeleteWah I wish I knew whether STI will give similar return anot leh! No crystal ball leh.. Haha but personally I do think 7% is can one la? Anyway I spread it out across a few indexes using the bogleheads method that's why I would say it should be fine.

Your term so cheap leh! Which insurer ah? But got cover early CI? If got pls email me and tell me which plan is it!

Too bad the ILP is the wife's, but I'll definitely have her cash out before the insurance portion rises significantly.

Hey Jes, found some articles on the STI annualised returns too.

Deletehttps://www.sias.org.sg/files/SGXMarketUpdates/10012018-STI-Dollar-Cost-Averaging-over-Past-Five-Years-Delivered7pa.html

https://www.fool.sg/2014/03/25/straits-times-index-etf-generated-8-4-annualised-returns-over-past-10-years/

these are just 5-10 year periods, longer periods I personally think should be thereabouts or higher if we dollar cost average into the ETF.

Having said that, I still prefer something similar to bogleheads portfolio method rather than dumping all in STI.

http://www.turtleinvestor.net/establishing-bogleheads-3-fund-portfolio-singapore/

Hi Wife Say I Niao,

DeleteI read before other articles also say 5-7%, thought you got your own formula to calculate too.

Mine is Prudential lor, my posts are here: https://simplyjesme.blogspot.sg/2016/01/why-i-change-ilp-to-term-insurance.html and https://simplyjesme.blogspot.sg/2017/02/going-in-depth-on-ilp-vs-term.html

I am not buying early CI because https://simplyjesme.blogspot.sg/2017/07/critical-illness-policy-and-early-stage.html

Hahaha, ok shamelessly sharing all my posts here. Insurance things too many points to discuss :)